How to Grow your Business Online: Part 1- Market Research

Posted by. Disrupt Tech. February 2, 2022

This is part 1 of the How to Grow Your Business Online series. In this four-part series, we are going to cover everything you’ll need to know to grow your business online. The first part is about Market Research.

The very first step of every business is research. In 2021, you need to watch everything with an analytical lens. Now, businesses can even observe the real-time interactions of their target market. You need to take advantage of it.

Data is available right in front of you. Your market is right there online, searching for things that are keeping them up at night. You just have to explore and dig around to unearth the game-changing insights.

Does it sound easy already? You could be wrong. According to a study by SAP Hybris,

“46% of consumers break up with brands for receiving irrelevant content pushes”

-Statista

As you can see, there’s no room for assumption. You need to know who your ideal customers are, what they are doing, where they are spending their time – with maximum precision.

Don’t worry. We’ve got you covered. In this very first part of the Online Business Growth series, we will guide you through a step-by-step process of online market research. So, let’s do it!

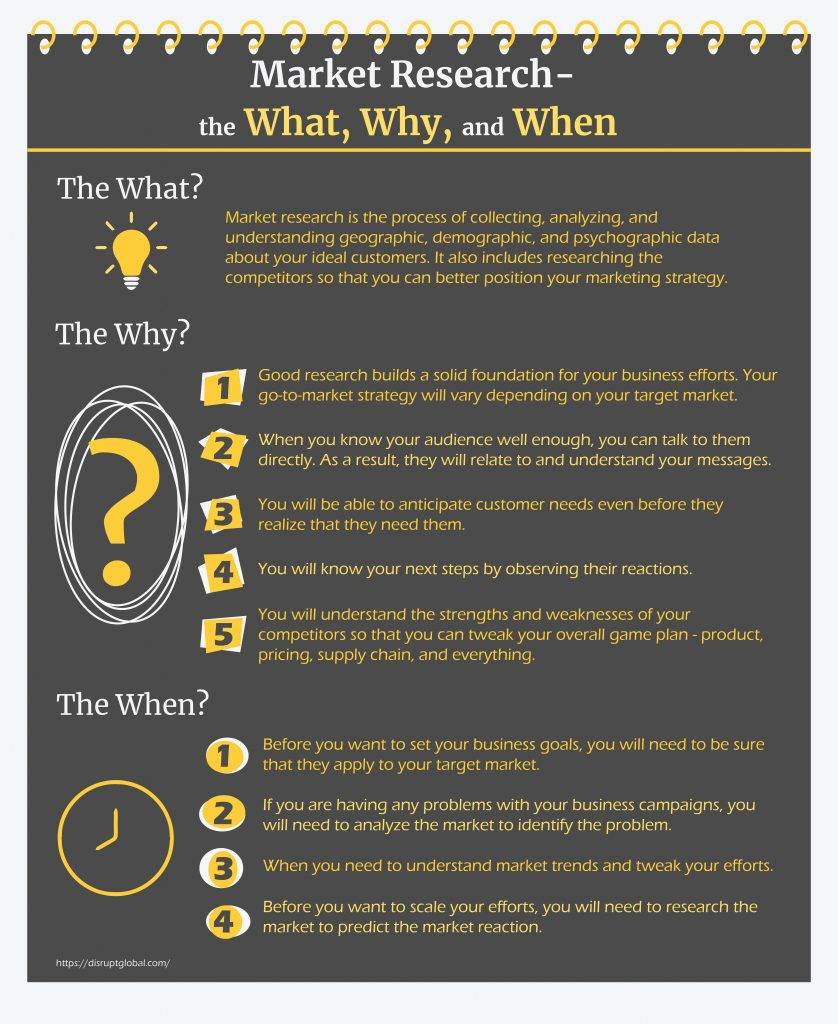

Market Research – the What, Why, and When

The What?

Market research is the process of collecting, analyzing, and understanding geographic, demographic, and psychographic data about your ideal customers. It also includes researching the competitors so that you can better position your marketing strategy.

The Why?

1. Good research builds a solid foundation for your business efforts. Your go-to-market strategy will vary depending on your target market.

2. When you know your audience well enough, you can talk to them directly. As a result, they will relate to and understand your messages.

3. You will be able to anticipate customer needs even before they realize that they need them.

4. You will know your next steps by observing their reactions.

5. You will understand the strengths and weaknesses of your competitors so that you can tweak your overall game plan – product, pricing, supply chain, and everything.

The When?

1. Before you want to set your business goals, you will need to be sure that they apply to your target market.

2. If you are having any problems with your business campaigns, you will need to analyze the market to identify the problem.

3. When you need to understand market trends and tweak your efforts.

4. Before you want to scale your efforts, you will need to research the market to predict the market reaction.

In short, before making any important business decision, you always need to revalidate with proper research.

Making the Hands Dirty

Step 1: Identify your Problem

You are not researching for the sake of researching. So, identify your problem and fix your research goals. For instance, you may have questions that need to be answered. Maybe you see a new opportunity. Or, perhaps you already have a hypothesis that you want to validate. Whatever it is, write down the problem and set the research objectives.

Step 2: Segment Your Market

Select your segmentation variable. It can be any demographic or psychographic variable like age, sex, company size, country, social status, lifestyle, etc. Then segment your market into homogeneous groups based on those variables.

Remember, selling to everyone is like selling to no one. It’s all about pinpointing specific segment/s that could be valuable customers for your business, finding their problems, and solving them. So before starting your research, you should be 100% sure about your targeted segment.

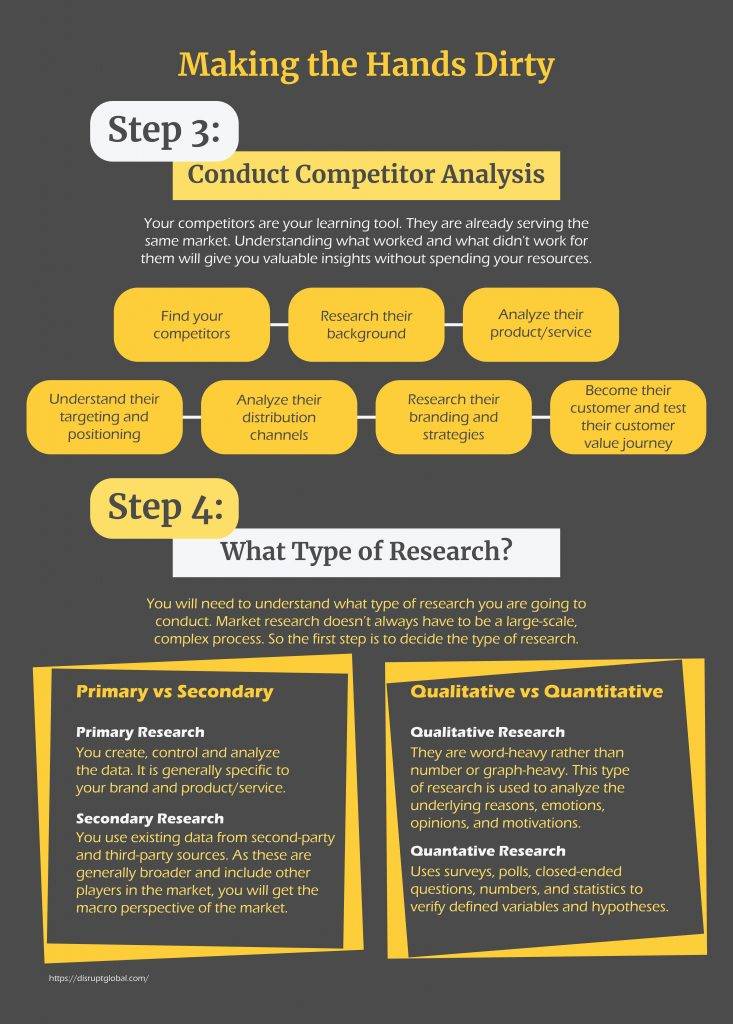

Step 3: Conduct Competitor Analysis

Your competitors are your learning tool. They are already serving the same market. Understanding what worked and what didn’t work for them will give you valuable insights without spending your resources. So,

♦ Find your competitors.

♦ Research their background.

♦ Analyze their product/service (strengths, weaknesses, features, pricing, reviews).

♦ Understand their targeting and positioning.

♦ Analyze their distribution channels.

♦ Research their branding and strategies.

♦ Become their customer and test their customer value journey.

Step 4: What Type of Research?

First, you will need to understand what type of research you are going to conduct. There’s no concrete set of rules. Market research doesn’t always have to be a large-scale, complex process. So the first step is to decide the type of research.

♦ Primary VS Secondary: Primary research is where you create, control, and analyze the data. Primary research is generally specific to your brand and product/service. In contrast, in secondary research, you use existing data from second-party and third-party sources. As secondary researches are generally broader and include other players in the market, you will get the macro perspective of the market.

♦ Qualitative VS Qualitative: Qualitative researches are word-heavy rather than number or graph-heavy. This type of research is used to analyze the underlying reasons, emotions, opinions, and motivations. On the other hand, quantitative research uses surveys, polls, closed-ended questions, numbers, and statistics to verify defined variables and hypotheses.

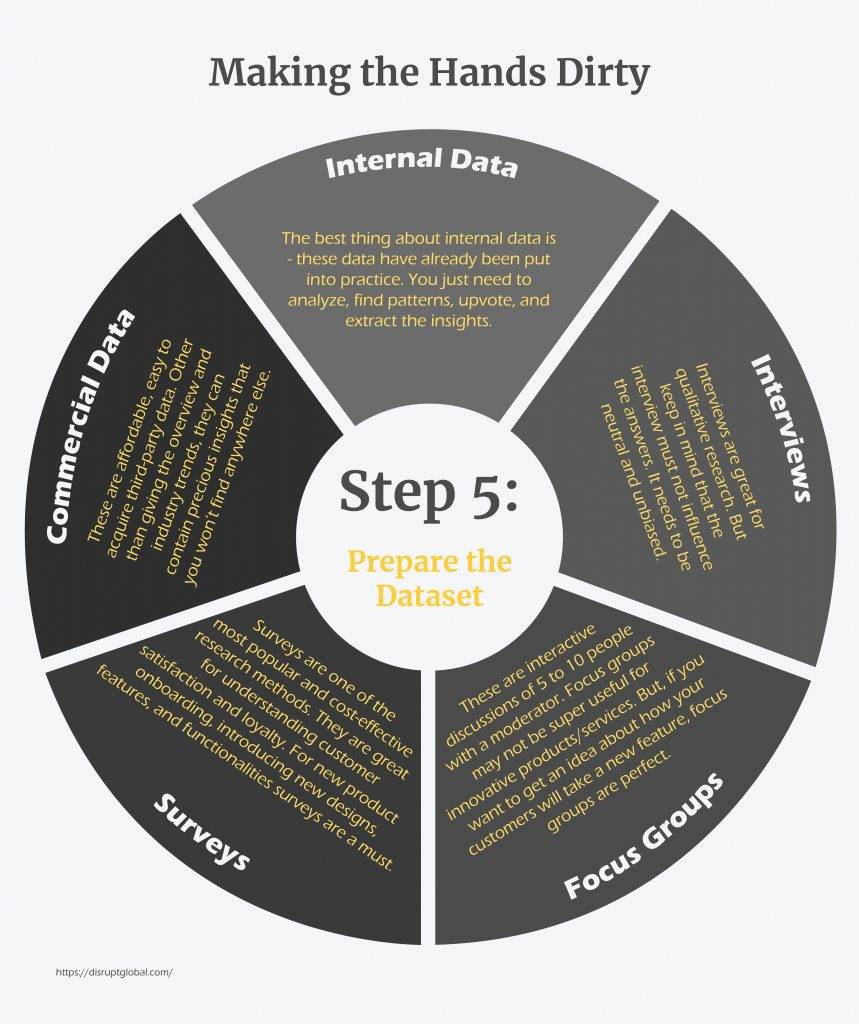

Step 5: Prepare the Dataset

Do you want to research the whole data source or choose a random sample? If running analysis on the entire data source is not viable, then you need to randomly select x number of individuals from every selected market segment that you made. You can also sample using other variables like paying and non-paying customers. It will largely depend on your problem.

Internal Data:

The best thing about internal data is – these data have already been put into practice. You just need to analyze, find patterns, upvote, and extract the insights. For example,

» Website metrics,

» CRM,

» Campaigns performance, etc.

Interviews:

Interviews are great for qualitative research. But keep in mind that the interview must not influence the answers. It needs to be neutral and unbiased.

Focus Groups:

These are interactive discussions of 5 to 10 people with a moderator. Focus groups may not be super useful for innovative products/services. But, if you want to get an idea about how your customers will take a new feature, focus groups are perfect.

Surveys:

Surveys are one of the most popular and cost-effective research methods, and for reasons. They are great for understanding customer satisfaction and loyalty. For new product onboarding, introducing new designs, features, and functionalities surveys are a must.

You should also try crowdsourcing, which lets the users add their own ideas, and upvote or comment on existing ideas.

Commercial Data:

These are affordable, easy to acquire third-party data. For example, data from Gartner, Pew, Capterra, etc. Other than giving the overview and industry trends, they can contain precious insights that you won’t find anywhere else.

Step 6: Analyze and Visualize the Data

Now the time to detect patterns and trends. First, categorize or structure your data for analysis. While analyzing, look for repeated data. This is the step where tools like Tableau and PowerBI come in handy. You can also try hardcore python or R coding if possible.

Last but not least, you need to present your data communicatively, so that decision-makers can realize which actions to take. Market research should always conclude with a proper action plan.